PROTECTION For Every Part of Life

Health Insurance

Supplemental

Disability

Workmans Comp

Identity Theft Protection

Million $ Baby

Key Man Insurance

...And More

At The Benefit Queen, our policies come infused with enhancements that allow you to accelerate your policy’s benefits to get much-needed money in your hands if you are to suffer a terminal, chronic, or critical illness – such as heart attack, stroke, or cancer diagnosis – or in case of a critical injury. It’s a game-changing feature that is revolutionizing the face of the life insurance industry, and we've has been leading the charge since 1998.

Watch the video to learn more about how Living Benefits life insurance works – and then take action to protect yourself and your finances!

What exactly is mortgage protection? Well, if you’re like most Americans, your home is the largest purchase you have ever made, and the most valuable asset you own, financially-speaking. Your mortgage payment is likely your family’s largest monthly expense, and you work hard to dutifully pay down your mortgage balance every month.

But what if you were to be diagnosed with cancer, and suddenly hit with unexpected medical bills?

In fact 60% of bankruptcies are due to a critical illness and 80% of those who filed for bankruptcy had a health insurance policy.

We believe that a solid financial foundation includes health insurance and yes, life insurance. Why? While most life insurance policies only pay out at death, our life insurance has “living benefits” – benefits you do not have to die to use!

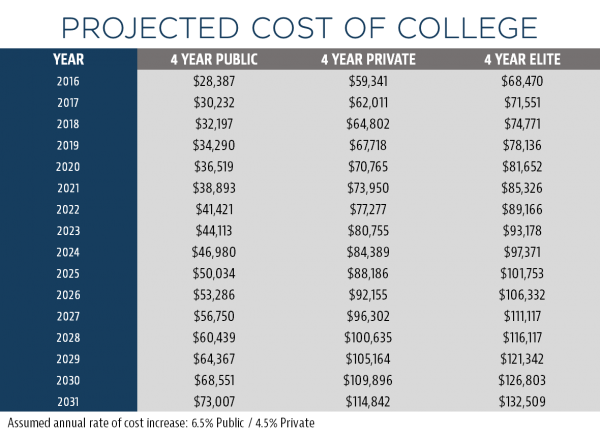

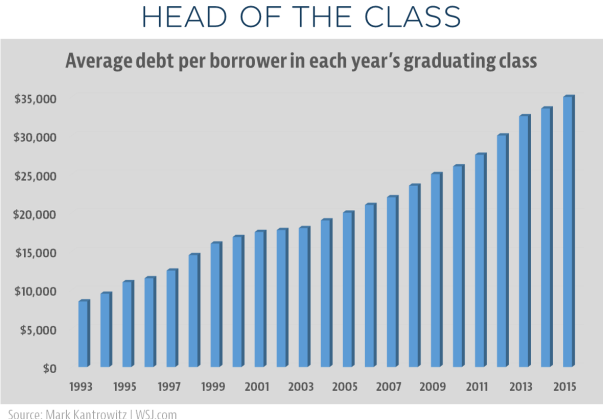

We all want what’s best for our children’s futures – for many families, that makes college planning and planning for college costs a top priority. However, quality higher education is coming at a premium these days, and all of the projections indicate that the trend will certainly continue in the coming years. Get started with your college planning NOW.

When faced with these numbers, it becomes more important than ever to make sure that you’re taking the proper steps to maximize the growth potential of your children’s college fund, while also protecting it against loss and taxation. But how much needs to be saved to ensure that your prospective college graduate won’t be saddled with crippling student loan debt by the time they earn their degree? What are the best, most effective vehicles for accumulating the largest fund possible? What tax-favored strategies are out there that can be utilized to maximize the purchasing power of those savings?

The Benefit Queen works with her clients to outline financial and savings solutions that fit their lifestyle and budget. The strategies we employ help to ensure your future college graduate will be armed with the vital education they need to thrive in today’s world, without being burdened with excessive student loans.

Why are so many American households unprepared for retirement? Did you know that:

Only 5 states require high school students to take a class about money!

The average American household only has about $135,000 saved for retirement!*

61% of people age 44-75 actually fear running out of money in retirement more than they fear death itself!**

40 % of pre-retirees are expecting a decline in their standard of living at retirement!*

Direct access to professionals when you need it – including 24/7 emergency assistance for covered emergencies

Easy to use services with a convenient mobile app

Coverage you can rely on – LegalShield provides protection for over 4 million people